This was a slogan from today's protest on Wall St. It concisely sums up the situation.

This was a slogan from today's protest on Wall St. It concisely sums up the situation.

Before the specifics of the situation have been addressed, there is a general lesson that we need to be reminded of. Every time the Bush regime tries to rush Congress and the public into something, they are perpetrating a fraud. We have seen that with the Iraq war, and we also are experiencing it with their efforts to rush into a war with Iran despite the fact that US intelligence has shown that Iran is making no efforts to develop nuclear weapons.

I have to admit that, at first, I was buffaloed by the runs on poorly managed investment banks and the hysterical corporate media coverage. However, in a couple of days, I have been able to come up with an alternative proposal that makes more sense. Here it is:

1) There should be no government guarantees of mortgage paper.

2) The government should offer tens of billions of dollars in assistance to people having trouble paying predatory mortgages. (This would be cheaper than what the ongoing bailout will cost us by far.)

3) There should be a 2 year moratorium on foreclosures, and all foreclosures during the last year should be nullified.

4) There should be a 3 year freeze on all increases of interest rates for Adjustable Rate Mortgages (ARMs). (Note that the Federal Reserve has been lowering interest rates for some time now. With reputable rather than predatory ARMs, interest rates and mortgage payments should be going down.)

5) After that, annual interest rate increases should be at no greater rate than the increase in Federal Discount Rates. (Obviously, the interest rates of the mortgages would need to be higher, but the increases should be limited.

If a lay person like me can come up with a plan that is cheaper, fairer, and better for our economy than the one that the Bush regime is selling, then that plan should be dismissed. If you knew more about the architect of the plan, Treasury Secretary Paulson, you would have even more reason to be suspicious. Naomi Klein on yesterday's Democracy Now! (bolding mine):

NAOMI KLEIN: You know, Amy, I don’t think we can stress this enough. Henry Paulson is one of the key people, the top people, responsible for creating the crisis that he is now claiming he will solve, you know, and this is—if we think about the 9/11 analogy and, you know, the state of shock that Americans were in after 9/11 and the emergence of Rudy Giuliani as the savior—and, you know, people have so much regret about that. And in the book, I write about this as the state of regression that we go into when we’re frightened. And I think Henry Paulson has really been cast in this role as an economic Rudy Giuliani, saving the day, impartial, bipartisan, a strong leader.

I found this article in BusinessWeek that ran when Paulson was appointed to the Treasury, and I just want to read you one sentence, because I think it’s all we need to know about Henry Paulson. This is from BusinessWeek, when he got the appointment as Treasury Secretary in 2006. The headline of the article is “Mr. Risk Goes to Washington.” It says, “Think of Paulson as Mr. Risk. He’s one of the key architects of a more daring Wall Street, where securities firms are taking greater and greater chances in [their] pursuit of profits. By some key measures, the securities industry is more leveraged now than it was at the height of the 1990s boom.”

Then it goes on to say that when Paulson took over Goldman Sachs in 1999, they had $20 billion in debts. When he—in these high-risk gambles. When he left, they had $100 billion, which means he took their risk level from $20 billion to $100 billion. So it is absolutely no exaggeration to say that Henry Paulson, far from speaking for Main Street, is actually bailing out his colleagues for some of the very debts that he himself accumulated. This is an extraordinary conflict of interest.

It gets even creepier:

AMY GOODMAN: It’s interesting who Treasury Secretary Henry Paulson is, served as an assistant to Richard Nixon’s assistant, John Ehrlichman, and moved right from there to Goldman Sachs, then became head of it when, well, the now-Senator and then-Governor Corzine left Goldman Sachs.

It's beginning to sound like Paulson should be facing an FBI investigation.

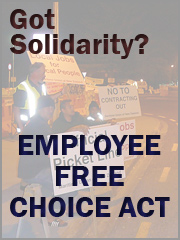

Here are some more shots from today's Wall St. protest. It is somewhat comforting to know that there are people who care enough about this to take action and who are smart enough to figure out that this bailout is a total scam.

Sorry that the pic is fuzzy. The sign says, "Jump, You Fuckers," which expresses the sentiments of a lot of Americans these days. (Update: Get Off This! has a better picture taken by Democracy Now! alum, Jeremy Schahill.)

Here's another crowd shot.

The following picture is of a small group of people doing street theater under the name "No Millionaire Left Behind." I think the guy on the right is really cute. Another guy from the group (not pictured) kept saying, "Bring us your blank checks."

'Jump you fuckers' is pure comedy gold, slap that on a t shirt and you could ride out the recession!

Gives me a warm glow to see those crowds. Now if only we could be sure Congress isn't wearing ear plugs.

I love this. I'm glad you got a pic (albeit blurry) of the "Jump, You Fuckers" sign. I really wanted one, but I didn't have my camera on me while I was down there.

Love your blog. Will be linking to it once I create my blogroll. Love it!

I'm not liberal, and I'm not a homo... but I am a libertarian. I totally agree with you... whenever the Bush admin says "act NOW or ELSE" they are perpetrating a MASSIVE FUCKING FRAUD. They are liars and alarmists- period.

The bill didn't pass, the stock market fell but is now recovering... and as far as all the markets being "frozen" - that is an absolute FRAUD - a lie.

There was no armageddon, the sun came up today,

What has really happened is the Libor rates and federal funds rates (the rates at which banks lend to each other) have risen. How much...? ONE percent. That's right folks.... they've gone from roughly 3% to roughly 4%. Now, you can say that's a 133% increase if you want to report it as an alarmist... but the truth is, it's one point. So money is going to be tighter, but if you're willing to pay a little higher interest rate, the money is still there.

Real-world examples.

- Instead of 0% financing on cars, furniture, and other crap that consumers should be paying cash for anyway... you will pay 4.8%

- Instead of 7% on a revolving line of credit for business (which business should NOT be depending on for payroll and other critical costs of doing business anyway)... your boss will pay 8.8 %.

- Instead of a 5.5% first mortgage... you will pay 7%. Hardly the worst rate in history.

- Instead of 14.9% on your credit card, it'll be 18.8%.

Any businesses who are so on the edge that a couple points on the dollars they are borrowing will put them "over the edge" as Bush, McCain, and others suggest... they deserve to be out of business.

McCain says "Inaction is not an option". YES IT IS.

Stay on your congressman/woman folks... STOP them from voting for this folly.